All you Need Know About the Initial One-Time Transfer to Akaun Flexibel (EPF Account 3)

Introduction

Starting from 11 May 2024, the Employees Provident Fund (EPF) of Malaysia has restructured its account system to better cater to the needs of its members. This restructuring involves the creation of a new account, Akaun Fleksibel (Account 3), designed to offer greater flexibility in managing your savings. To know more on the restructure, click here. (everything you need to know about the restructure blog).

One-Time Transfer Opportunity

From 12 May 2024 to 31 August 2024, EPF members an opportunity to transfer part of their Akaun Sejahtera (formerly Account 2) balance to the new Akaun Fleksibel. This one-off transfer allows members to allocate a portion of their savings into the new flexible account, enhancing their financial planning capabilities. The transfer can be made only once and cannot be cancelled or reversed once completed.

How much can I transfer to the Akaun Flexibel during the One-Off Transfer Period?

The amount that can be transferred depends on the amount that you have in your Akaun Sejahtera (formerly Account 2) originally, in which there are three scenarios. All scenarios involve the movement of funds OUT OF Akaun Sejahtera into the other account(s) depending on the scenario.

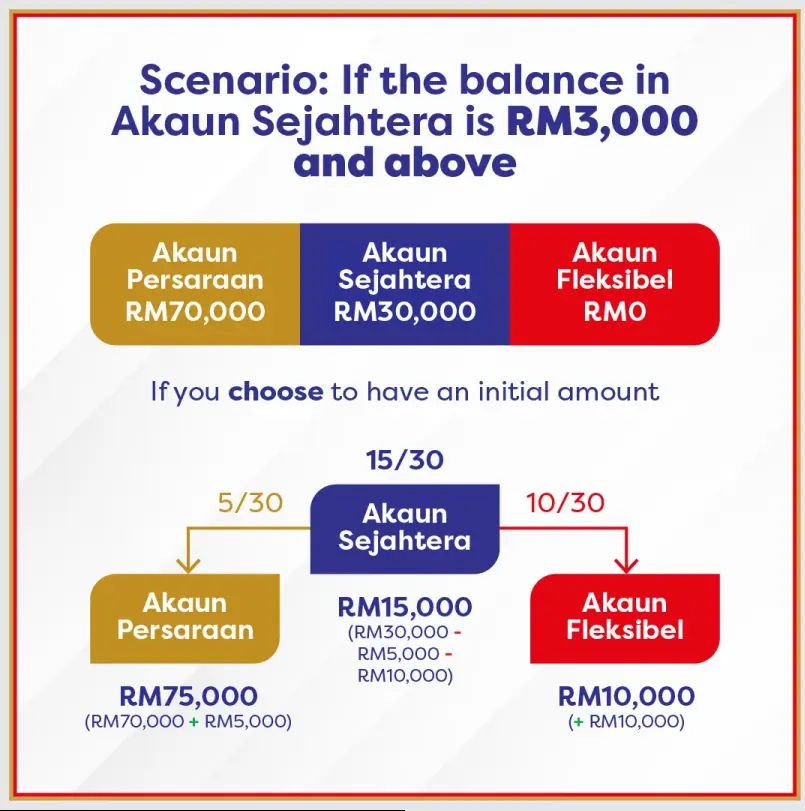

Scenario 1:

If the Akaun Sejahtera balance is more than RM3,000, then 15/30 would remain in Akaun Sejahtera, 5/30 would be transferred to Akaun Persaraan, and 10/30 would be transferred to Akaun Flexibel.

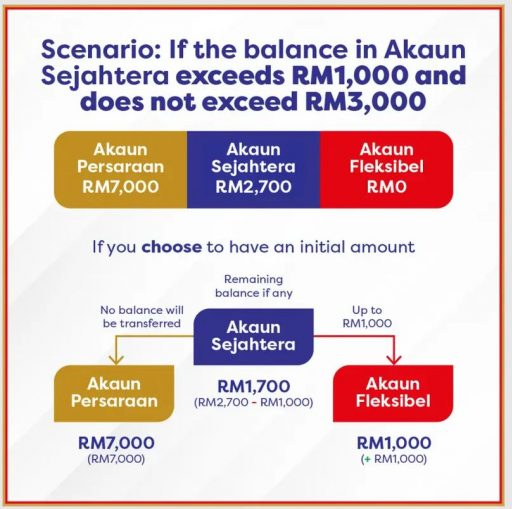

Scenario 2:

If the Akaun Sejahtera balance is between RM1,000 and RM3,000, then RM1,000 would be transferred to Akaun Flexibel, while none is transferred to Akaun Persaraan.

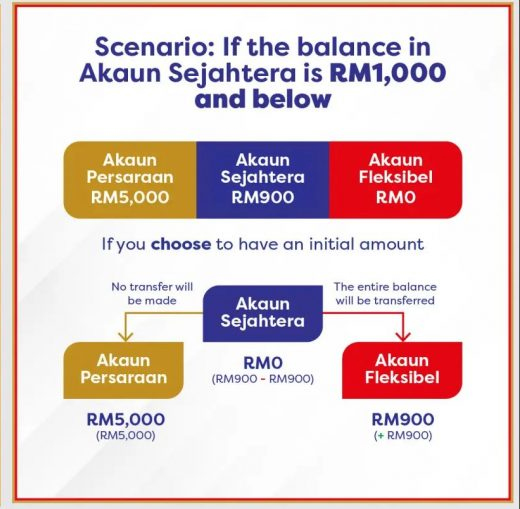

Scenario 3:

If the Akaun Sejahtera balance is less than RM1,000, then all of the balance in Akaun Sejahtera will be transferred to Akaun Flexibel.

How to Initiate the One-Off Transfer

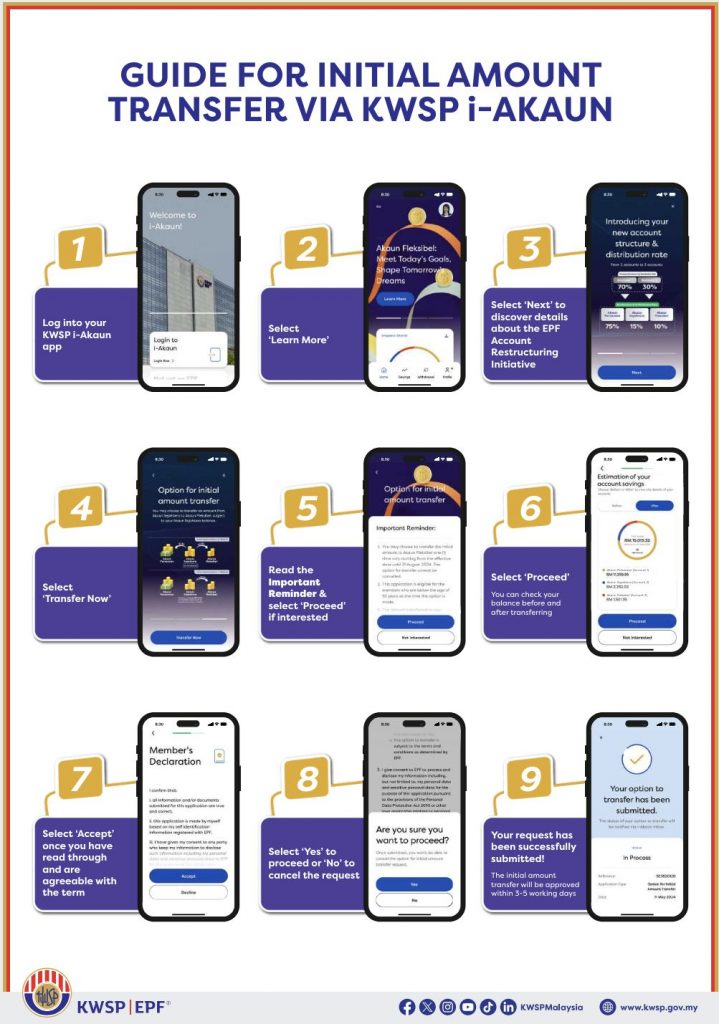

You can initiate this transfer using the KWSP i-Akaun app or by visiting any EPF office to use the Self-Service Terminals (SST). Here’s a step-by-step guide by KWSP for using the KWSP i-Akaun app:

Benefits of Akaun Fleksibel

Akaun Fleksibel provides members with more control over their funds, allowing them to better meet short-term financial goals while still preparing for retirement. This flexibility is particularly beneficial for managing unexpected expenses or investments in personal development.

Conclusion

The one-off transfer to Akaun Fleksibel is a strategic move to enhance your financial planning and secure a flexible future. Ensure you take advantage of this opportunity within the stipulated timeframe to make the most of your EPF savings.