Navigating the complexities of payroll management is a crucial aspect of any business operation. For an in-depth exploration, check out our latest Payroll blog: What is Payroll? | Complete Overview on Payroll Process. However, the traditional approach of manual payroll processing without a structured system or policy poses numerous challenges. This article delves into the common issues encountered during manual payroll management, shedding light on the potential challenges and complications businesses often face.

Common Challenges in Processing Payroll Manually :

1. Risk of Human Error :

Relying solely on manual data entry for payroll calculations is a recipe for potential errors. Inaccuracies in computations not only lead to financial discrepancies but also consume considerable time, diverting focus from more strategic tasks. A simple typo or miscalculation can significantly impact employee satisfaction and financial stability.

2. Compliance Challenges :

Staying abreast of evolving tax regulations, employment laws, and compliance requirements is a daunting task without automated assistance. Failure to adhere to these regulations may result in severe penalties, financial losses, and legal ramifications, thus underscoring the importance of accuracy and compliance.

3. Data Security Risks :

Handling sensitive employee information manually poses inherent security risks. Safeguarding data privacy and protection against cyber threats becomes pivotal, as any breach can compromise the integrity of employee information and lead to trust erosion within the organization.

4. Complexities of Benefits and Deductions :

Managing diverse employee benefits, deductions, and allowances without an organized system introduces complexity. The manual processing of these elements increases the likelihood of errors, potentially affecting employee satisfaction and financial well-being.

5. Time-Consuming Reconciliation :

The manual reconciliation of payroll data, encompassing employee hours, leaves, taxes, and other variables, proves highly time-consuming. This exhaustive process detracts from productivity and may result in delayed Salary disbursements.

6. Lack of Integration :

Disconnected systems and the absence of integration with HR or accounting software impede seamless payroll operations. The disjointed approach often leads to inefficiencies and hampers the ability to streamline processes.

7. Employee Satisfaction :

Inaccuracies or delays in payroll processing directly impact employee morale and satisfaction. Such shortcomings breed distrust within the workforce, leading to decreased productivity and tarnished organizational reputation.

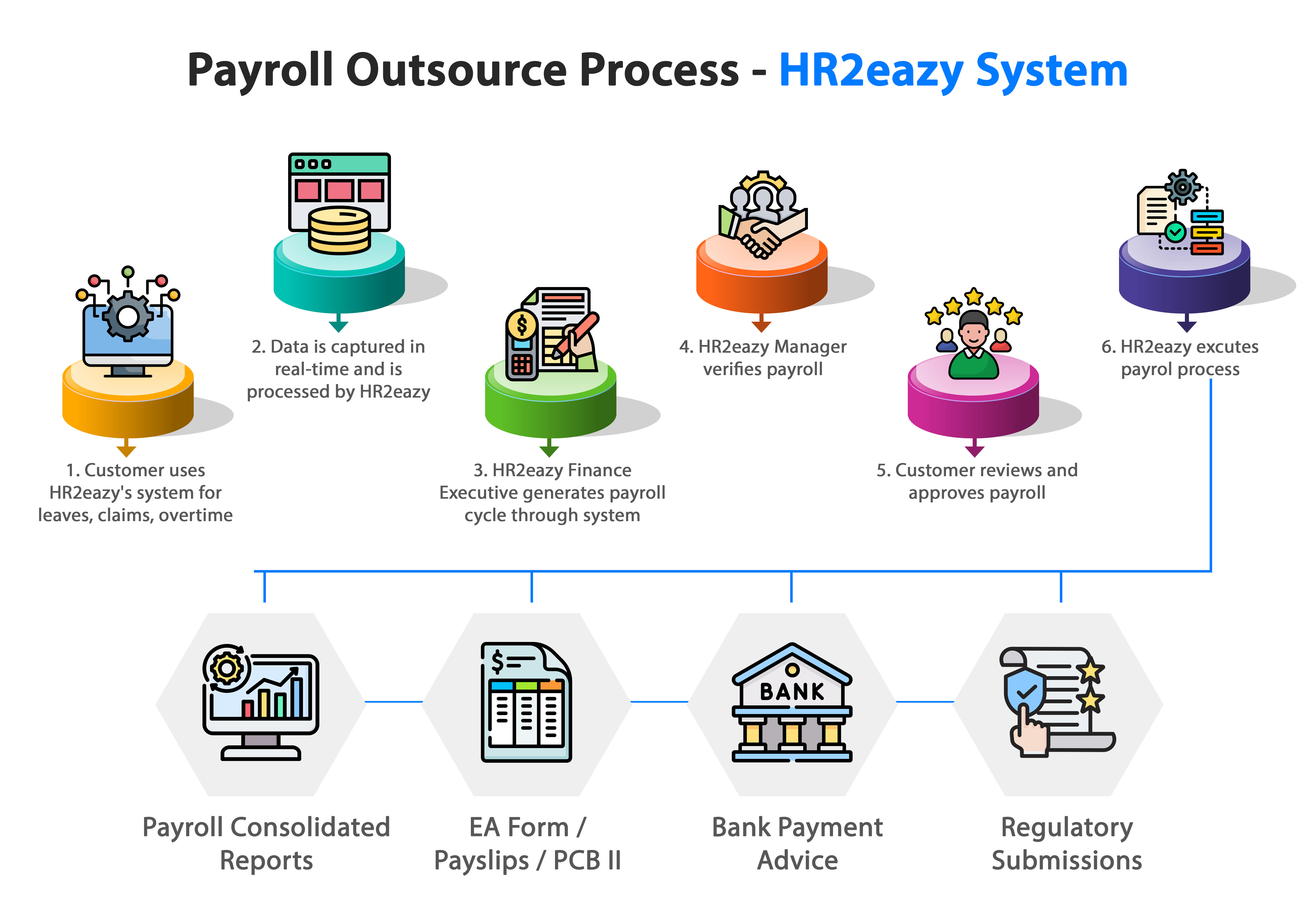

How can HR2eazy Help you Perfect Your Payroll Management?

The inherent challenges within manual payroll processing underscore the critical need for an automated and integrated approach. Embracing modern payroll systems not only alleviates these challenges but also enhances accuracy, compliance, and overall operational efficiency. By recognizing these pitfalls and transitioning toward automated solutions, businesses can streamline payroll processes, mitigate errors, and foster a more content and productive workforce.

Decided to outsource your payroll services to us? We offers comprehensive payroll outsourcing services with top-rated software and highly experienced professional to help your company.

Ready to leave these Top payroll problems behind?

Explore our solution with HR2eazy payroll software today!

Get Free Demo Get Started