Payroll in a Nutshell

What is payroll? What are the stages in payroll management? Who takes care of the payroll in the company? Read this blog to learn about the basics of payroll and how you can optimise your payroll processes to increase its efficiency, while making more time to focus on core business matters.

The Basics of Payroll

Amongst many things, payroll is the task (usually taken up by the finance department) of making sure that ALL your employees are happily paid ON TIME. Depending on the company’s policy, payroll can either be conducted monthly, weekly, or even for some industries, daily. On top of the punctual salary disbursements, the finance, payroll or HR execs associated to payroll need to make sure that all statutory regulations are complied to. This may include the registration of staff to relevant government bodies, such as EPF, as well as preparation of reports or payslips for the staff at the end of every month.

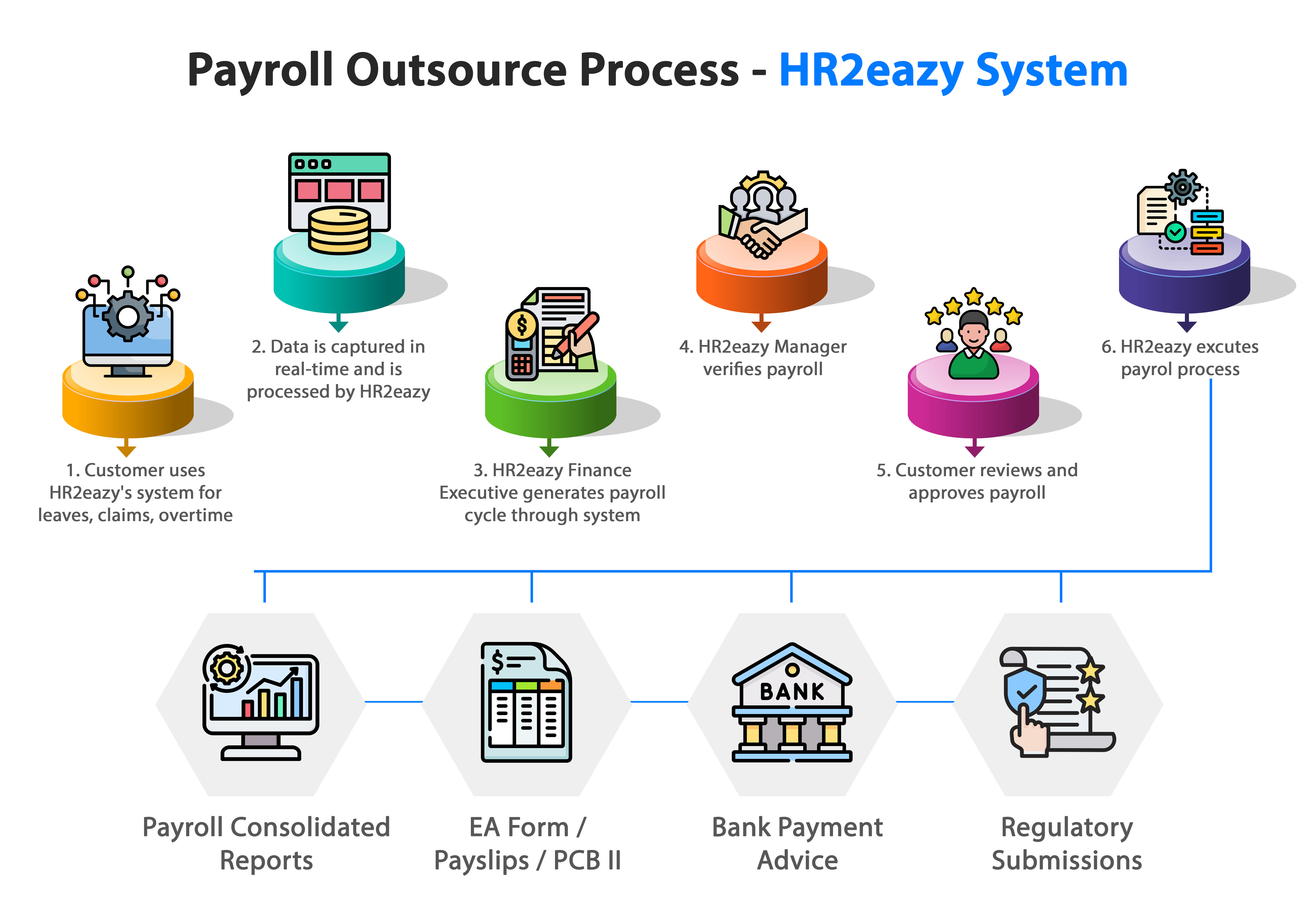

How does HR2eazy Help you Perfect Your Payroll Management?

The Overview of Payroll

Managing payroll involves complex calculations, adherence to regulations, and timely disbursements. For many businesses, the tedious processes can become overwhelming, leading to errors and inefficiencies. A payroll process typically follows the following procedures :

1. Employee Information Gathering

collecting essential details such as employee names, addresses, tax withholdings, bank account information, hourly rates, deductions and more. For new employees, it is important that they are registered to the mandatory regulatory bodies such as EPF, SOCSO, EIS and more.

2. Time Keeping and Attendance and Claims

recording employees’ working hours, leaves, overtime hours and claims (travel, business, entertainments claims and more)

3. Salary Calculation

Determining the compensation for each employee based on their pay structure including regular pay, overtime, bonuses, and commissions, taking into account their time attendance and claims over the month (before a cut-off period).

4. Statutory and Other Forms of Deductions

Subtracting tax and other deductions such as Employee Provident Fund (EPF), The Social Security Organisation (SOCSO), the Employee Insurance Scheme (EIS), the Human Resource Development Fund (HRDF), Monthly Tax Deductions (MTD/PCB), etc.

5. Net Pay Calculation

Calculating the final amount that an employee shall receive after all the deductions from gross earnings. This is the amount that would be transferred over to the employee’s bank or E-Wallet account.

6. Payroll Processing/Generation

Generating payslips, direct deposits, bulk payments, or other payment methods as per the payment schedule stipulated in your company policy.

7. Compliance and Reporting

Ensuring adherence to statutory requirements with mandatory documents such as EA Form, Form E, PCB II and more

8. Distribution of Payslips

Distributing payslips or statements to employees, detailing their earnings, deductions and net pay. All the deductions such as EPF, SOCSO and EIS MUST be detailed in your payslip. For more on payslips, click here (to link to a blog on payslips).

9. Record-Keeping

Maintaining accurate records of payroll transactions, tax filings, employee details, and other related documents for auditing and compliance purposes.

10. Continuous Updates and Reconciliation

Regularly updating employee information, adjusting for changes in tax laws or company policies, and reconciling payroll records for accuracy.

Say Goodbye to Manual and Paper-Based Payroll Processes

Switch to Automated Payroll Software for Efficiency and Accuracy

Get Free Demo Get Started